Value Added Tax (VAT)

What is Value added Tax (VAT)?

Value added Tax (VAT) is a consumption tax that is assessed on products at each stage of the production process from labor and raw materials to the sale of the final product.

Output tax and input tax

Output tax is the VAT charged on the sale of goods &/services from your business, if its VAT-registered. Input tax is the VAT charged on the sale of goods & or services to your business, if its VAT-registered. VAT is calculated as the difference between the Output tax and the input tax.

Who is supposed to register for VAT?

It is not every business that is supposed to be registered for VAT. A trader is mandated to register for VAT if the value of taxable supplies exceeds or is expected to exceed the VAT threshold (ZWL $1 000 000) within a period of 12 months. Whenever the business reaches or anticipates to reach or exceed this threshold, it should register for VAT without fail or risk mandatory VAT registration which is normally punitive in nature due to backdating.

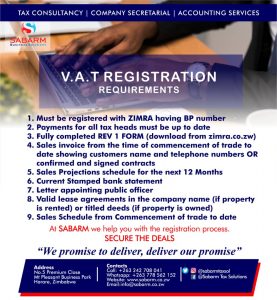

The requirements for VAT registration

For all VAT registration contact Sabarm today and get professional assistance at your convenience. The following are the requirements for VAT registration.